Startup Budget to Actuals

- Josh Aharonoff

- Feb 21, 2022

- 5 min read

Updated: Aug 1, 2025

Whether you're an individual tracking your personal spending or a CEO running a startup, setting a budget helps you better manage your finances and make informed decisions. A key resource in determining if you're making the best decisions possible is the Budget to Actuals report. The Budget to Actuals report shows your actual financial performance in comparison to the budget you set.

Why do you need a Budget to Actuals? This tool provides insight into whether the assumptions you made were accurate, as well as helping you identify any areas that need to be revisited - both positive developments and areas of concern. A properly done Budget to Actuals shows the health of your budget, and how close you are to being able to accurately predict future performance.

This insight into the state of all aspects of the business is helpful for the company to make more informed decisions going forward.

It's also helpful for investors and other key stakeholders to have confidence in the plan that you present. There really is no downside to using a Budget to Actuals. Any result provides actionable information.

To get started, before you can prepare a Budget to Actuals report, you need to first create a proper budget. As I've previously written, this should cover your income statement, balance sheet, and cash flows.

Once you have a budget in place, you first want to ask yourself, who exactly is this report going to?

For example, is this going to your board of directors? If so, is it because you just had a recent fundraise where you presented them with a budget and a use of proceeds, and you're now reporting how close you were to what you forecasted?

Or maybe you're preparing it for a typical Q3 board meeting, where your board is getting together and just want to make sure that things aren't going off the rails?

Or maybe this is only for internal use, where your team wants to understand how good of a job you are all doing. They can use it to make informed decisions and identify any areas for improvement.

It's important to ask yourself who this report is going to because you may want to include different details for different audiences.

If it's for your investors, you may want to highlight certain areas such as your revenue or other metrics that have been identified as key to your success.

If it's for internal budgeting, you may want to prepare something in a more detailed fashion for a department head. The beauty of a detailed Budget to Actuals report is it provides plenty of options.

After you have identified the audience, you are ready to design your Budget to Actuals.

To begin, start with a summarized version of the data

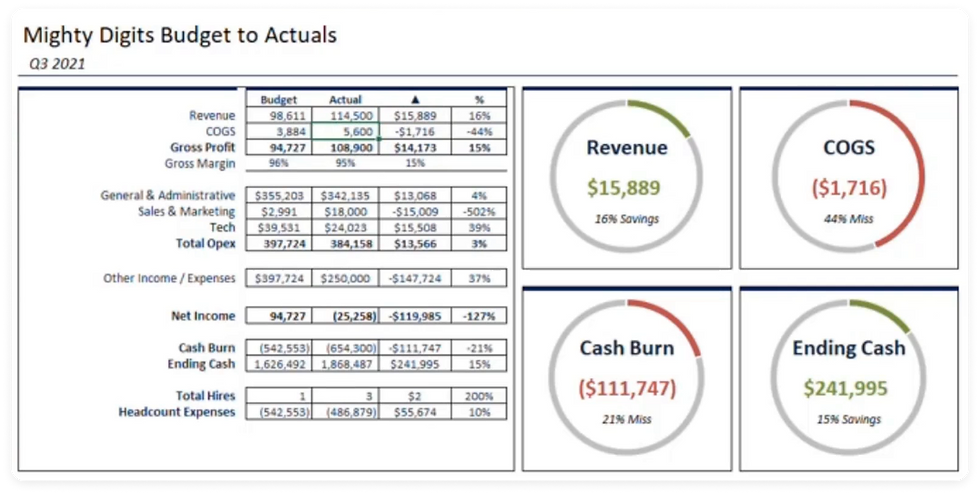

I like to include Revenue, COGS, Gross Profit, Operating Expenses by department, Other Income and Expenses, and Net Income.

I then like to show two line items for Cash - one for Cash Burn and the other for Ending Cash. This is also where you can include other KPIs that may be especially important to monitor.

In this example, I'm using Hires, but you could include Customer Acquisition Cost, Lifetime Value, Total Customers, or whatever KPIs are integral to your business' success.

And again, it all goes back to who you're going to show this report to.

In comparing your actual results to the budget, I prefer to structure your variances in a way that all "good" variances show as positive and all "bad" variances show as negative.

In the example, for Revenue I'm taking Actual minus Budget, which shows that I had higher revenue than originally forecasted.

For COGS, I'm taking Budget minus Actual, to show that expenses were higher than forecasted, but that this negatively impacted the business. A lot of people do this differently, but for me, this is the best way to show variances.

In addition to the dollar amount of the variances, you should also include the percentage of the variances, to better understand the magnitude of the variances.

Looking at just one of these columns won't be enough. You have to look at both of them side by side. For example with COGS, it was off by 44%, but that's only $1,700. If you're a startup with $5 million in funding, this dollar amount isn't really too significant.

Once you have your Budget to Actuals on a summarized basis, you then want to drill into the details of what exactly went into creating each variance.

In this example, we're able to drill into our individual budgets and understand which line items were off, and which are causing the biggest impact to the bottom line.

For example, in Sales & Marketing we were under budget in Marketing Expenses, Conference & Events, and Commissions, but way over budget for PR Fees. This allows us to analyze our assumptions that we originally made. Was this a one-time PR event that won't be repeated? Does it turn out PR is more important than initially though to the success of our marketing? Taken all together, it would seem that we came in under budget for Marketing & Sales, but looking at it at this granular level provides more detail and is where actionable decisions can be made . The idea is that if you start on a summarized basis, you could then get into the weeds of the areas that you've identified as needing further analysis.

Relatedly, a common trap that I see founders falling into is mixing good variances with bad variances to mask just how serious of a problem they have.

If you don't get to the level of detail needed, you may miss the signals that you have a serious gap in where your projections are for each of these sub-accounts, and won't be able to make informed course corrections.

Keep in mind, this is just one format, and for just one period. You may actually want to show how you're doing for a specific period, as well as year-to-date.

Here's a different format in which you could tell the same story:

As with any information that you're trying to convey, the best way to do it is via a nice, easily digestible design. Here are my three favorite graphs to use when preparing a Budget to Actuals.

The first includes a bar chart with a line as to what was budgeted, making it very easy to understand whether you're below or above what you forecasted.

Here we have two bar charts, a blue and a light blue, and then we have green for the areas in which we hit versus what we missed in red.

And then of course you could just do a traditional line chart showing one for budget and one for actuals.

Overall, it doesn't really matter what design you use, as long as it ultimately conveys the message that you want to give your audience.

By using a Budget to Actuals, you will be able to make better strategic and operational decisions, as well as keep stakeholders informed.

Feel free to download our Budget to Actuals Template to make it even easier for your company to get started.

Josh Aharonoff CEO and Outsourced CFO for startups

Hey - thanks for checking us out!

Would your startup benefit from dedicated Accounting & Finance expertise? We'd love to talk!

We crunch your numbers so that you can focus on what matters the most - growing your business.

Comments